Nadia Simmons: In our previous Oil Update we examined major factors, which previously fueled the price of light crude. Before we move on to the technical part of our Oil Update, let’s take a closer look at the events of the previous week.

Nadia Simmons: In our previous Oil Update we examined major factors, which previously fueled the price of light crude. Before we move on to the technical part of our Oil Update, let’s take a closer look at the events of the previous week.

At the beginning of the last week President Barack Obama won the backing of key figures in the U.S. Congress, including Republicans, in his call for limited strikes on Syria. Additionally, a missile test by Israeli forces training in the Mediterranean with the U.S. Navy set nerves on edge. These circumstances fueled the oil market and resulted in a sharp pullback to over $108 per barrel. In spite of this growth, in the following days, the price of light crude was trading in the narrow range between the Tuesday’s low and top.

Looking at the chart of crude oil, we can conclude that investors came back to focusing on economic data, because further improvement in the U.S. labor market is the key for the Fed to begin scaling back its $85 billion a month of bond purchase. Friday’s data showed that U.S. employers hired fewer workers than expected in August and the jobless rate hit a 4 and a half year low as Americans gave up the search for work.

The weaker-than-expected U.S. payroll numbers for August raised doubts about whether the Federal Reserve will start paring its massive stimulus and resulted in higher prices of light crude.

Another factor, which fueled the price of light crude was the G20 summit in St. Petersburg. According to Reuters, crude oil rose 2% after President Obama told, that failure to act against Syria’s use of chemical weapons would embolden “rogue nations” to use them too. The U.S. President has faced growing pressure from Russia, China, the European Union and major emerging market countries not to carry out a strike without support from the U.N. Security Council. Taking the above into account, there are concerns about how the crisis could affect relations between Washington and Russia and China.

In spite of this, the main worry now is that Iran, an ally of Damascus, could get involved if the United States goes ahead with attacking Syria. In this case, the entire region could become inflamed yet further, causing major oil supply problems.

What impact did these circumstances have on light crude? Crude oil climbed above $110 per barrel. This is a largest weekly percentage gain in two months, at 2.7%, the highest since July 5. It is also the largest daily percentage gain since August 27.

Keeping in mind these factors and their impact on the price of light crude, let’s now move on to the technical part of our Oil Update. Just like a week ago, we take a look at the charts from different time perspectives to have a more complete picture of the current situation in the oil market.

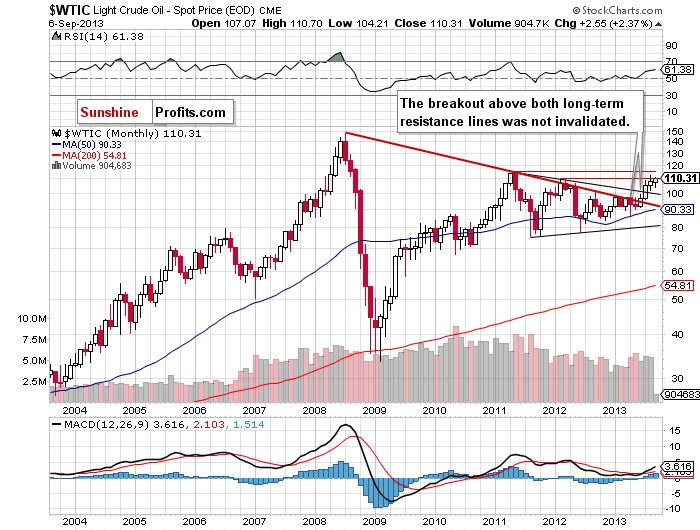

Let’s start with a look at the monthly chart of light crude (charts courtesy by http://stockcharts.com).

Looking at the above chart, we see that the situation hasn’t changed much.

Quoting our last Oil Update:

(…) light crude still remains above the two long-term declining resistance lines: one of them (bold red line) is based on the July 2008 and the May 2011 highs, and the second one is based on the September 2012 and March 2013 highs (the upper black line).

From this perspective the picture is bullish and the breakout above these two long-term declining resistance lines hasn’t been invalidated.

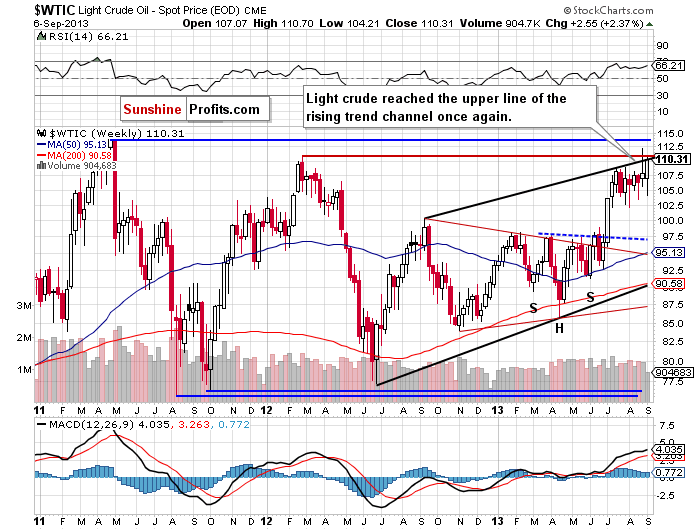

Now, let’s zoom in on our picture of the oil market and see the weekly chart.

On the above chart, we see that the situation has improved recently. Although the price of light crude dropped below $105 per barrel at the beginning of the previous week, oil bulls didn’t give up and pushed it higher in the following days. In this way crude oil reached the strong resistance zone based on the March 2012 top and the upper border of the rising trend channel once again.